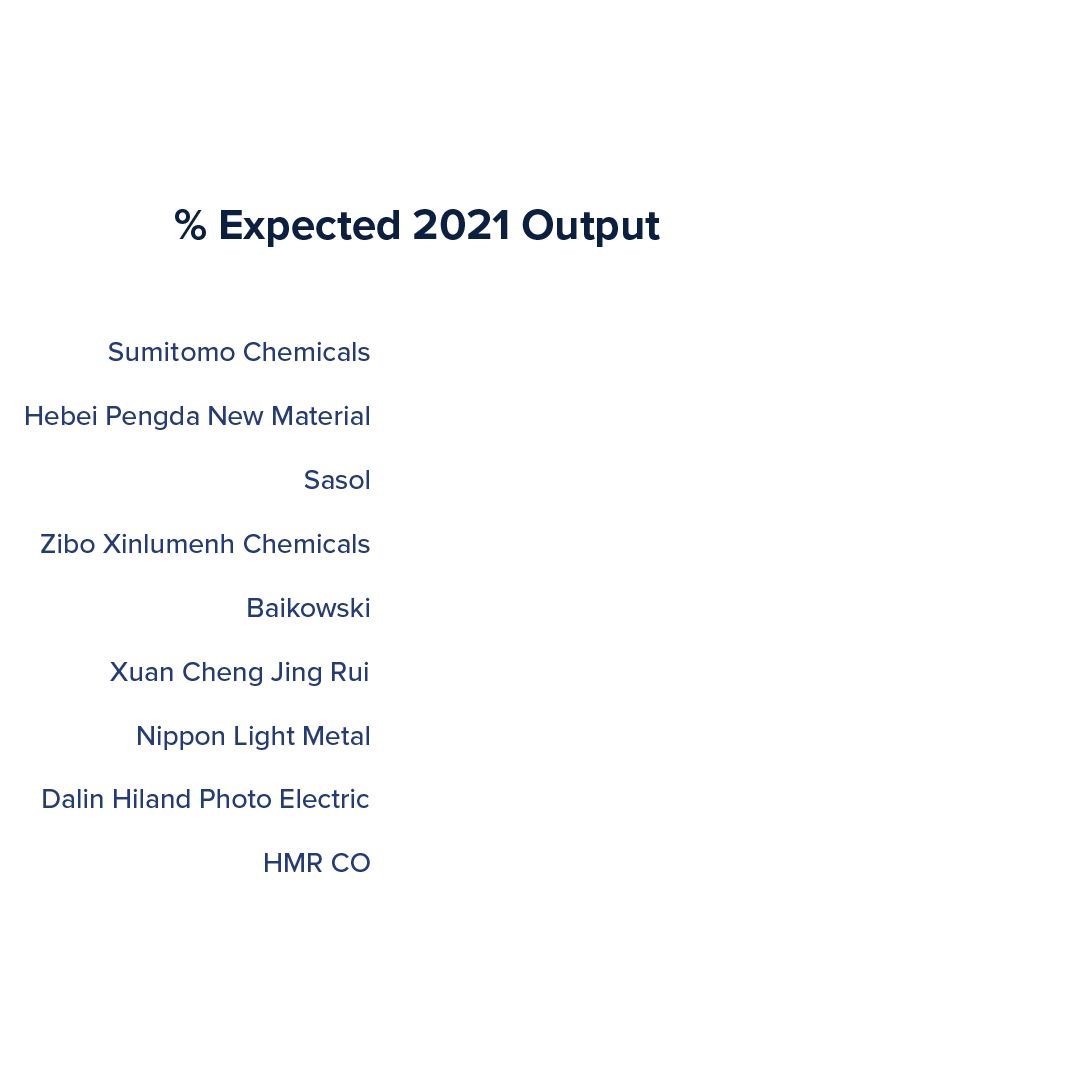

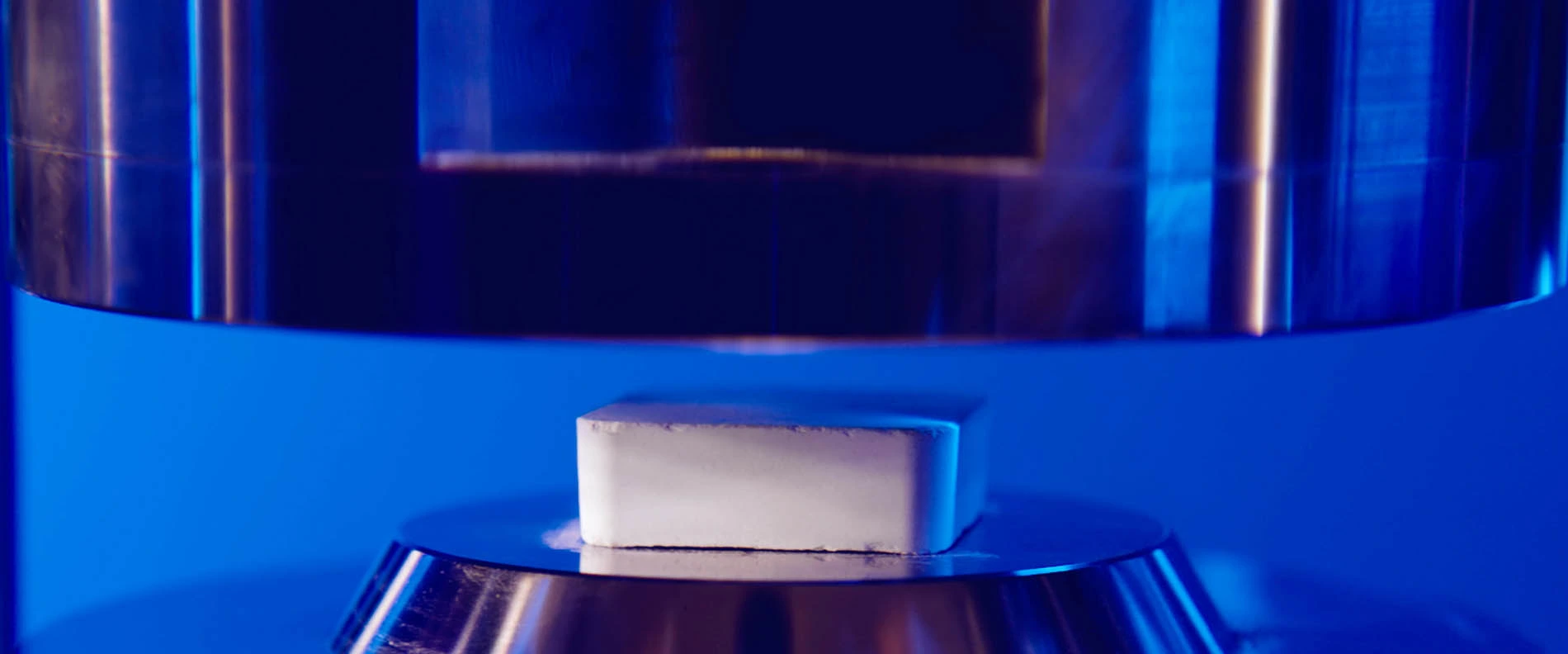

Alpha HPA’s Smart SX Technology delivers some of the highest purity aluminium products in the world, at world-leading margins in a first class jurisdiction and with a very low carbon footprint.

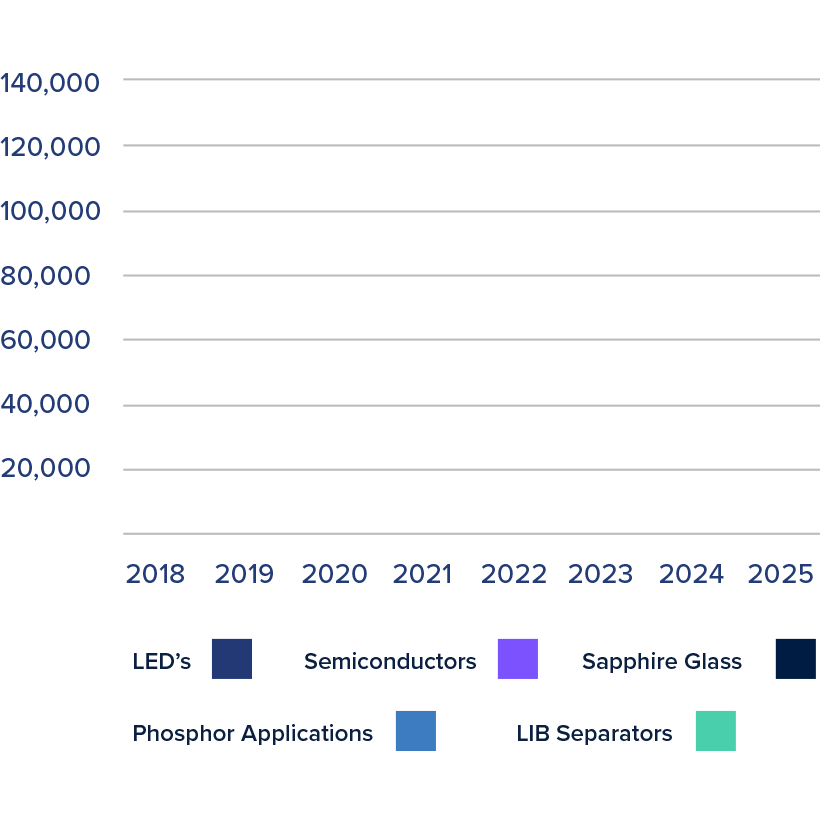

Alpha HPA’s products are in growing demand as the world’s technologies and governments respond to a once in generational technology shift to meet the challenges of de-carbonisation